Dec 1, 2024

November is the first month for which we have payment statistics on payments in many different crypto. As promised previously in (the October Update), we want to share these statistics so that other merchants who might be interested in accepting crypto payments can get a sense of what to prioritise in integrating.

For the transaction count we only counted deposits of $0.10 and up, since this is what we have as a minimum for most chains.

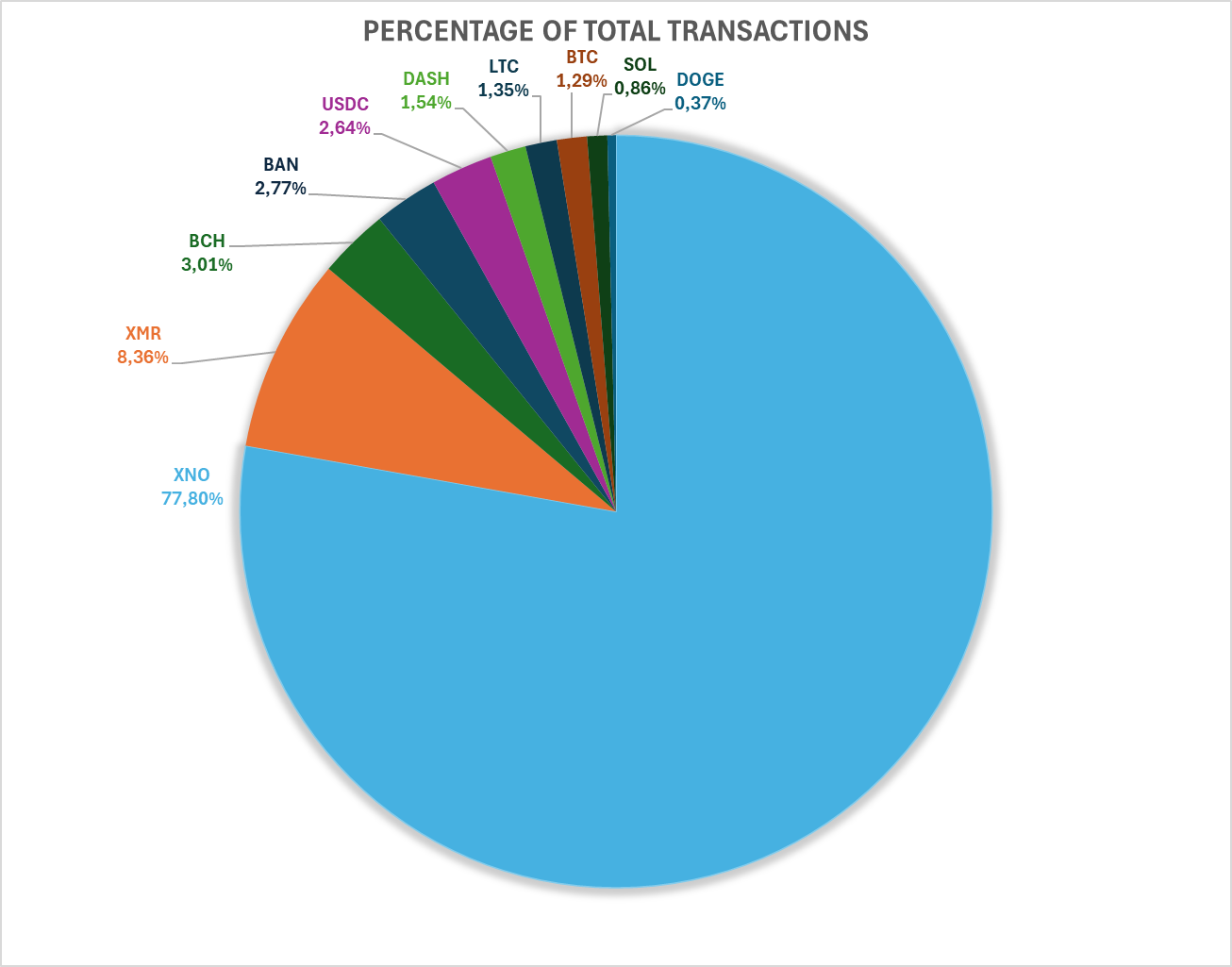

Nano (XNO) dominated the transaction count, accounting for 77.8% of all payments. This was followed by:

Or in pie chart format, for easy sharing:

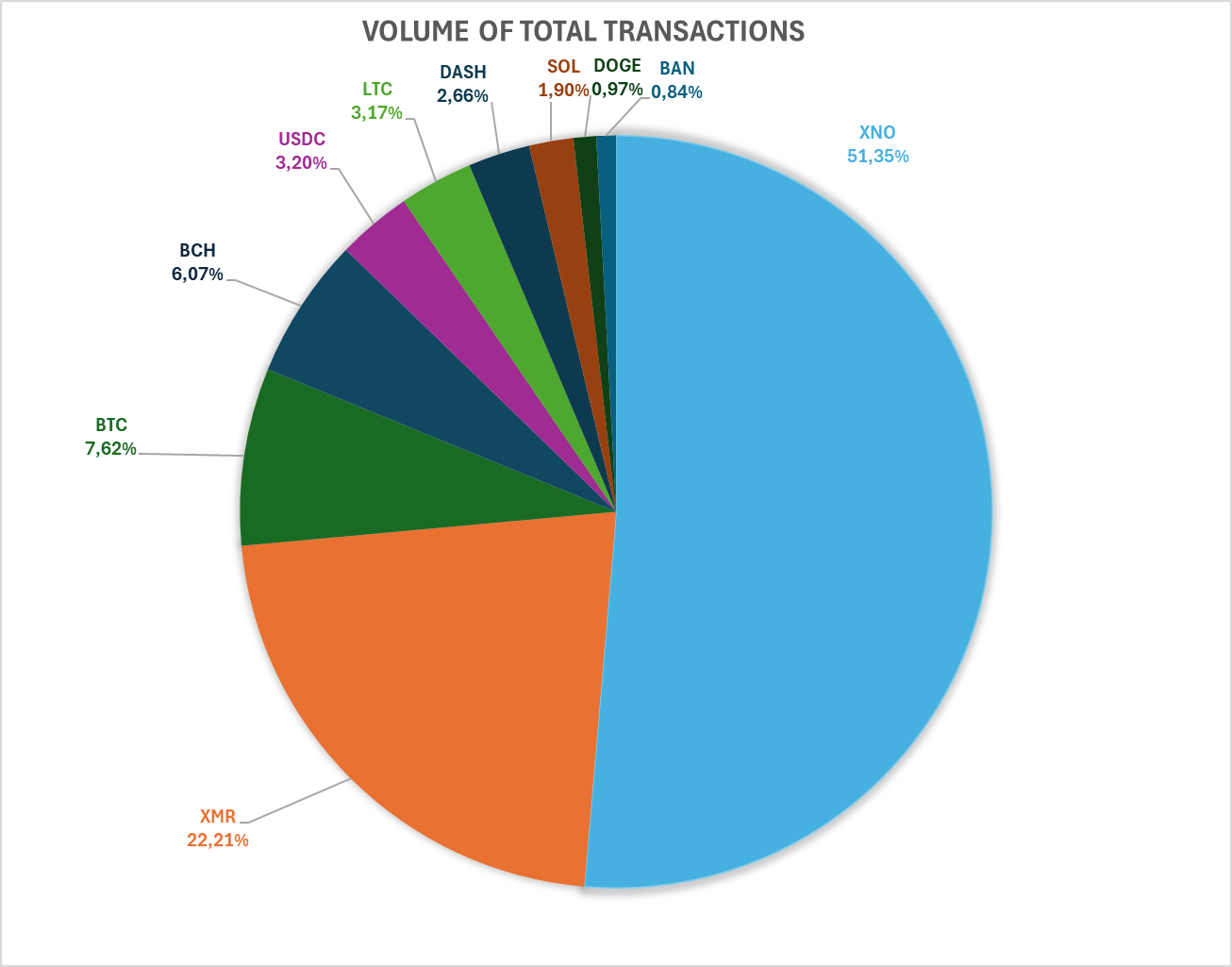

When looking at the perhaps more important and harder to game total deposited amount (volume) via the different coins the distribution shows a slightly different pattern:

Or in pie chart format, for easy sharing:

Nano clearly dominates in terms of both transaction count (77.8%) and volume (51.3%). This is unsurprising, as it is the payment method we originally started with, that we prefer to accept given that it has zero fees, and since we believe it is the best way to do payments it makes sense to us to see it on top!

Monero, despite being a far more recent addition, also sees huge usage. At just 8.4% of the transaction count yet 22.2% of the volume it accounts for almost as many transactions and as much volume as the rest of the non-Nano chains combined. To us this makes a lot of sense as NanoGPT has a strong focus on privacy and this clearly aligns well with Monero private, cypherpunk spirit.

Bitcoin is an odd one in that while the total transaction count is low (1.3%) it accounts for over 7.6% of the total volume. Payment fees are relatively high on Bitcoin, so it makes sense that when people choose to use it for payments they will do so with larger amounts at once, rather than doing more smaller transactions.

The contrast is especially clear with the more payment-oriented Bitcoin Cash, which given its low fees people feel okay using for small deposits. It adds up to 6.1% of the volume with 3.0% of the transaction count. Bitcoin Cash was one of our first additions and we still see usage of it growing, but usage on other chains is currently growing faster.

Banano is a funny one (as Banano often is) in that it accounts for a lot of transactions, but the majority of them are very small. In fact, the majority of the volume comes from a few big outliers, while most transactions we saw were below even 10 cents! Since Banano is feeless like Nano, people are happy to use it for small deposits.

The other coins saw good usage but less so than for the big chains. USDC on ETH and L2s saw a lot of relatively small deposits, with only Nano and Banano having smaller average transaction size. We would have expected the same on SOL, but the average transaction size on SOL (including USDC on SOL) was actually twice as big as USDC on ETH, and higher than transaction sizes on DASH and BCH.

We were also surprised to see DASH having higher transaction count than Litecoin, though Litecoin did (just) beat out DASH in terms of volume. Frankly we expected to see more usage of Litecoin given how it always ranks highly in BitPay's statistics, but perhaps we're simply not reaching the Litecoin community enough!

Finally, everyone's favorite dog coin Dogecoin saw the lowest amount of transactions done, though the volume was higher than that of Banano. We wish we could explain this better since Doge has a high market cap and a very active community, but so far usage has been relatively low.

We're very much wondering how we see these trends changing over time, and will post a new update when we have the figures for December!